Negative PE ratio is derived on account of loss on the earnings of a company. Such a PE ratio is invalid and cannot be used to make any investment decision. The Balanced Advantage Funds are designed to arrange the composition of equity and debt in the scheme on the basis of current market conditions and expectations in the future.

If the P/E is low relative to its historical levels, that is a potential buy signal. A stock with a low P/E is considered to be cheaper and therefore a bargain. However, there may be cases where other indicators are more useful.

They invest in companies where earnings are growing faster than the stock price. In such a case, they believe that its earnings will ultimately justify its high price tag. A PE ratio of 30 tells that investors are willing to pay INR 30 for every INR 1 of the company’s earnings.

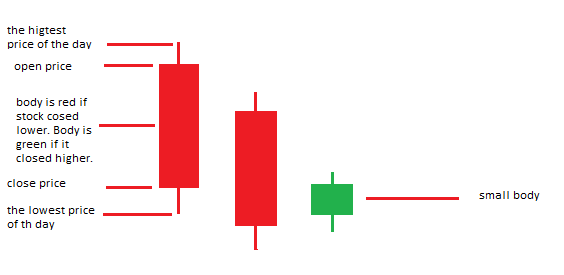

Understanding PE ratio

Pay 20% upfront margin of the transaction value to trade in cash market segment. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Please ensure you carefully read the risk Disclosure Document as prescribed by SEBI. Please ensure you carefully read the risk Disclosure Document as prescribed by SEBI/FMC.

What is a good PE ratio?

To give you some sense of what average for the market is, though, many value investors would refer to 20 to 25 as the average P/E ratio range.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Calculating the Price to Earnings Ratio: An Example

Markets are not as pricey as they appear, but the risks have grown. Investors may be adept at spotting companies with a promising future in terms of development and return on investment, but this alone may not guarantee the greatest results in the future. By purchasing equities that appear to be underpriced, value investors might bet on those companies being re-discovered by other investors and then profit from the resulting price correction. In other words, buying low and selling high is the core principle of value investing, which may sound simple but is difficult to execute.

- However, they stop responding when client demands return of amount invested and profit earned.

- If the P/E is low relative to its historical levels, that is a potential buy signal.

- In other circumstances, the two variables should provide two distinct outcomes.

- You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources.

If a stock has a lower than average P/E, it indicates that the stock prices are disproportionately valued to the company’s earnings, hence are undervalued. Such a situation can be considered as a positive indicator for investments, as you can acquire these stocks at a relatively lower price than their relatively higher-priced peers. As mentioned earlier, stocks in different sectors trade in different valuation ranges. Usually stocks with higher earnings growth potential have higher PE ratios.

How Does Price to Earning Ratio (P/E Ratio) Work?

Still, a high PE Ratio can be deceptive of the actual financial situation of the company. For example, when a company buys back its shares, it reduces the number of claims in the market, thereby increasing the earnings per share and decreasing the value of the PE Ratio. The first and foremost reason can be a loss-making company or a company that has made no earnings this financial year. When a company incurs a loss or has made no profit in a financial year, the PE ratio is not provided for that company.

The first is to compare similar stocks, for example, two stocks in the same industry. The stock with the lower P/E is cheaper and could be a better investment. pe ratio formula With relative PE ratio, the absolute ratio of a company is compared against a benchmark P/E ratio, or the past PE ratio of respective companies.

PE ratio cannot be considered in isolation while investing in stocks. Other fundamental factors, the company’s financial performance, etc. must be considered before investing in a stock. Furthermore, a stock with high PE is often considered to be overpriced. To compute the relative PE ratio, you have to compare the absolute ratio of a company with the benchmark P/E ratio or a range of past earrings over a period of respective companies. Therefore, investors use this ratio to measure the company’s performance in relation to past or benchmark ratios. A question that riddles investors when using P/E ratio to decide where to invest is what can be considered as a good or safe ratio.

The Relative PE Ratio is a complex methodology that compares the latest Absolute PE Ratio with a range of past PE Ratios from a specific period, like the last decade. Looking at PE ratios and rejigging your portfolio can be a lot of work, and most people avoid this hassle. Luckily, there is a way to automate this with Balanced Advantage Funds. Hence the longer your goal duration, the less variable and more predictable will be your returns. In fact, if we take a PE ratio slab of 18 to 22 (that’s 20 plus-minus 2), you will see that the PE ratio was within this band in only 37% of these 261 months. The NIFTY had a PE of less than 18 in 84 months, and the NIFTY PE ratio was over 22 in 81 months.

Drawbacks of Price to Earnings Ratio

However, this is not a practice in the market because it is pointless. We can find out what an investor is expecting from a stock company by analysing the PE Ratio of that company. A company with a high PE Ratio suggests that the investor expects the company to deliver increased earnings in the future.

At the onset, we must clarify that the ideal PE Ratio varies from sector to sector, and it is also dependent on the market conditions and the industry-wise performance. A significant drawback of Trailing PE is that it demonstrates the past performance of a company rather than the future. But, Investors mostly shell out their money based on future expectations. The company’s earnings release estimates the potential earning expectations of the company. If you are a market-savvy investor who wants to make intelligent investing decisions, you must already keep your tabs on the PE Ratio. There is no optimal or ideal ratio for any particular stock or industry.

In the purest form, the true value of a company is the sum of the discounted present values of all future cash flows. This is often computed using the Discounted Cash Flow method which is extremely difficult and cumbersome. While the PE Ratio is widely used for its simplicity, it cannot be relied upon as the only valuation methodology. It must be used in combination with other valuation methodologies to arrive at more accurate and conclusive valuation in the process of fundamental analysis. For instance, a lower P/E ratio, lower price/earnings-to-growth ratio, lower P/B ratio, higher dividend yields, etc., can help you find undervalued stocks. Investors often consider a lower P/E ratio better as it signifies that they are paying a lesser price per rupee of the company’s earnings.

Is 0.5 a good PE ratio?

A ratio between 0.5 and less than 1 is considered good, meaning the stock may be undervalued given its growth profile. A ratio less than 0.5 is considered to be excellent. For a guide on how to use the PEG in your investing, check out this article.

So, if your investment horizon is short, i.e., 3 to 5 years, then you should be careful about the levels at which you are entering the market. These are used to ascertain how well a company has performed in relation to the industry standards which are determined by its benchmark or past trends. An exactly opposite conclusion can be drawn when the relative ratio is less than 100% as it will imply that the entity has underperformed.

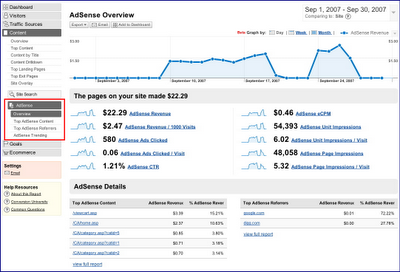

It is believed that the point at which you enter the market determines the returns you make. Well, this might be true most times, but there are other ways of looking at it. Let’s understand this using the NIFTY 50 data over a long period as an example. In the above graph, we can see that in January 1999, the NIFTY was at 966 points, and today has grown by over 11 times to 11,248 points at the end of September 2020.

Cyclical industries, which see a rise and fall in demand with seasons, show lower PE ratios while other sectors like pharma and IT, a higher PE ratio. P/E ratio cannot be considered in isolation and must be seen along with the category averages or industry averages. Since 1996, Equitymaster has been the source for honest and credible opinions on investing in India. With solid research and in-depth analysis Equitymaster is dedicated towards making its readers- smarter, more confident and richer every day. Here’s why hundreds of thousands of readers spread across more than 70 countries Trust Equitymaster. It can also be used to compare a stock or index with itself over time.

We have also looked at the CAGR of these stocks for a 10-year time period. Stocks with the CAGR of more than 15% form part of this selected list of stocks. While the past track record of stock movement is no guarantee of future returns, capital gains in markets are about probability.

PE ratio, is the ratio of a company’s price per share to earnings per share. Whether a specific level of P/E ratio is high or low depends upon the industry average or P/E valuation multiples of peer companies. The ideal P/E ratio range may also differ from one sector to another.

However, a low PE Ratio may indicate that the company is undervalued and is performing better than in its past performances. There is no specific value for the investors to rely on while analysing the PE Ratio of a company. A higher value of the PE Ratio can signal risky value trap investments. In comparison, a lower value might indicate fundamental faults in the company that might result in its sub-par performance. Assuming that the FMCG sector’s average P/E is 20, stock M has a P/E of 20, and stock N has a P/E of 40.

Many people in the stock market use P/E because it shows how much you are paying for a dollar of profit. The price-earnings ratio is the most popular measure of stock-market valuation. If the PE ratio is high, then investors think that yields will be increased in future and vice versa. Investors prefer to invest in companies that generate steady cash flows at an increasing rate.

Is low PE ratio good?

Many investors will say that it is better to buy shares in companies with a lower P/E because this means you are paying less for every dollar of earnings that you receive. In that sense, a lower P/E is like a lower price tag, making it attractive to investors looking for a bargain.